In a period when financial services are being transformed by digital innovations, online apps for personal loans have surfaced as handy avenues for swift fund acquisition. Yet, the multitude of choices can make picking a quick loan app that’s custom-fit to individual preferences quite daunting. To simplify this procedure, a systematic step-by-step comparison can be vital in pinpointing the perfect online personal loan application.

- Assessing Your Needs: Start with assessing your monetary needs. Figure out the size of the instant personal loans you require, how long to pay it back, what interest rates are manageable for you, and any particular characteristics that are essential given your situation. Grasping these main elements is very crucial in shaping your decision-making process.

- Research and Compare: Dive deep into investigating various digital loan assist platforms. Review their online sites, peruse client feedback, and weigh up rankings in app markets. Be aware of the interest charges, additional costs, qualification parameters, duration of loans, and application method. Assist yourself with refining your choices by coming down to those apps that are a good fit for your needs.

- Interest Rates Vs. Charges: Analyze the interest rates and related fees associated with different applications. Some may provide an easy EMI loan with lower lending charges but include hidden expenses. On the other hand, others might present higher interests yet lesser supplementary costs. Consider all borrowing expenses for a well-informed choice.

- Eligibility Criteria: Individual apps have varying requisites relating to income, credit limit, employment details, and residence specifics. Evaluate which services align with your qualifications to sidestep needless declines that could impact your credit status.

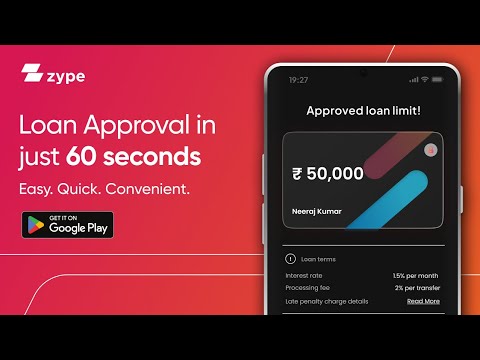

- Application Process: Assess the simplicity and quickness of the application process. Certain applications pride themselves on a swift, uncomplicated application system that requires minimal paperwork, whereas others may employ more complex techniques. Seek out an app with an effortless yet effective setup.

- Customer Support and Services: Explore what level of customer assistance is presented by each app. Ongoing support can be critical, as complications may surface during or after the post-application period. Applications featuring full-scale help avenues are guaranteed to offer a stress-free journey.

- Security and Data Privacy: Prioritize apps that prioritize the security of your personal and financial information. Look for applications that use encryption and additional protection measures to safeguard your private data.

- Repayment Flexibility: Check if the app offers a flexible repayment option, such as early repayment without penalties, flexible EMIs, or extensions in case of financial hardships. Flexibility in repayment terms can be advantageous.

- Reviews and Recommendations: Get feedback from your social circle, relatives, or online groups who have utilized these applications. Actual user stories can provide crucial understandings about the app’s dependability and ease of use.

- Concluding Choice: After considering all elements, establish a tactical decision resting on what matters most to you. Opt for an application that aligns with your financial requirements while ensuring a hassle-free lending process.

Wrapping up, picking a suitable digital personal loan platform demands a thorough investigation, detailed comparison, and matching your financial aims with what the application provides. Going through this compare-and-contrast method will allow applicants to navigate through numerous available possibilities and make a well-educated decision that superbly addresses their credit requirements.